Pennsylvania’s Public-School Employee Retirement System (PSERS) employer rate is set at 34.51% for the 2020-2021 school year. For every one dollar of eligible wages, thirty-four and a half cents are contributed into the PSERS plan.

Over the past ten years:

- The employer PSERS rate has increased over 720%;

- The plan underfunding was approximately $44.1 Billion;

- The funded ratio has decreased from 79.2% to 58.1%;

- Annuitant members (those receiving benefits and not paying into the system) has increased from 38.9% to 48.1% and growing each year.

In a recent press release on May 22nd, PSERS Executive Director Glen R. Grell stated “Since the March 16 office closure, PSERS has processed over 963 retirements”.

Because of COVID, the unfunded liability will be exacerbated by:

- Decrease in the number of employees paying in to the system due to layoffs;

- Continued increase in the number of retirees collecting benefits;

- Reduced investment value of assets.

Today’s schools – including charter schools – are forced to pay for decades of under-funding and poor performance of investments. We encourage all charter schools to join the dozens that have already successfully transitioned to alternative 403b plans without degrading their talent pool and while freeing up tens or even hundreds of thousands of dollars to serve students.

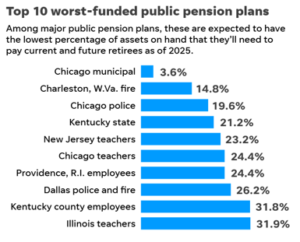

As reported by USA today and from a national perspective, PA is not yet in the 10 worst-funded public pension plans. USA Today Link